Contactless payments are rising in popularity. In fact, a recent market insight report notes that the global contactless payments market is expected to grow to $26.3 billion by the end of 2027. Aside from tap-to-pay cards and mobile wallets, biometrics payments are another contactless payment method that is gaining significant market traction. These kinds of payment methods utilize facial recognition systems, iris scanners, and vein recognition technology to facilitate safe and secure transactions.

Biometrics payments have become appealing for a lot of companies as customers continue to adopt this type of innovative payment solution. Here, let’s discuss how biometrics payments benefit your business.

Helps ease anxious customers

Part of the reason why contactless and biometrics payments have picked up steam is due to the global health crisis. Because health directives call for hand hygiene and social distancing measures, more and more customers have ditched cash and switched to contactless payment methods. By allowing your customers to authorize transactions using their physical features, you can provide them with a sanitary payment experience and give them peace of mind. Imagine, instead of entering their passcode on the PIN pad or holding dirty cash, your customers can easily pay you simply by scanning their retinas or waving their palms.

Enables a seamless customer experience

Your business will greatly benefit from employing biometrics payments as these allow for a fast, easy, and hassle-free user experience. Biometric authentication relies on the physical features of your customers, so they won’t have to fumble remembering complex passcodes or worry about bringing their cards or key fobs. By having your customers scan their faces, retinas, or veins to complete a transaction, your business’ payment and identification process will be more convenient and user-friendly.

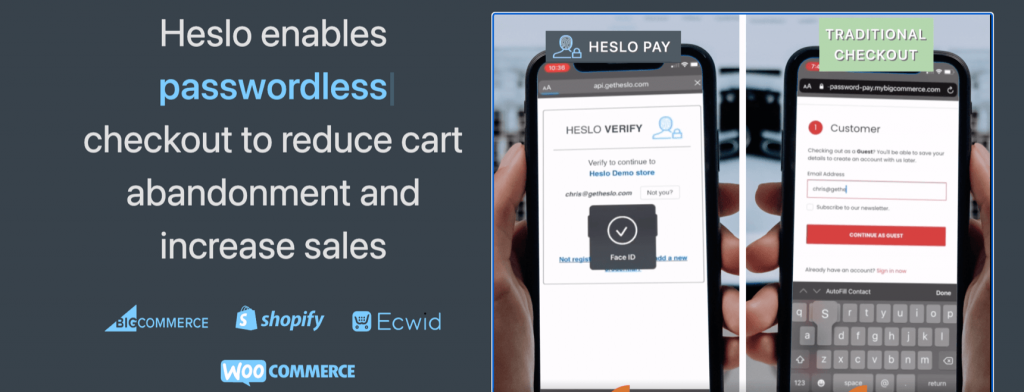

Shopify

This benefit isn’t limited to face-to-face business transactions. Even businesses that are on eCommerce platforms can use biometrics technologies to ensure a smooth customer experience. Partnering with startup Heslo Pay, eCommerce platforms such as Shopify and BigCommerce will soon replace their traditional checkout pages with biometric authentication.

Heslo users can save their face biometric data and fingerprint to confirm their payments for the aforementioned eCommerce platforms.

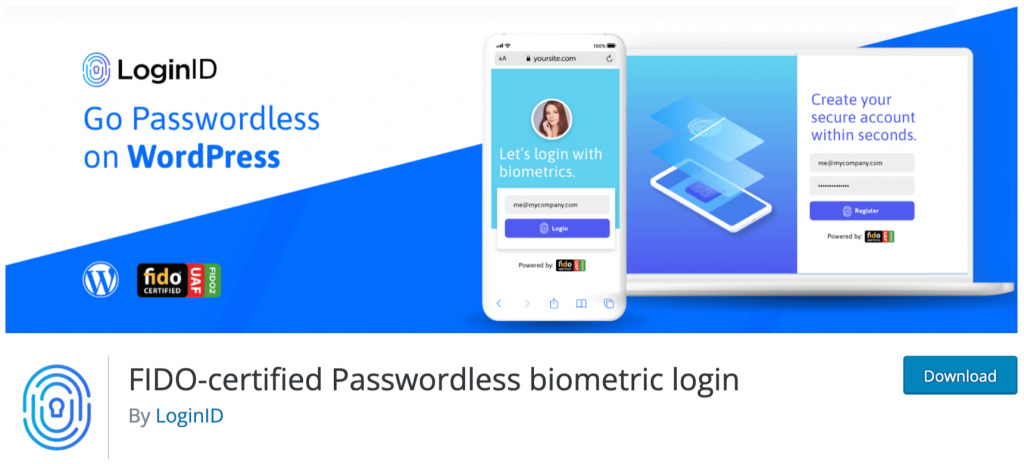

WooCommerce

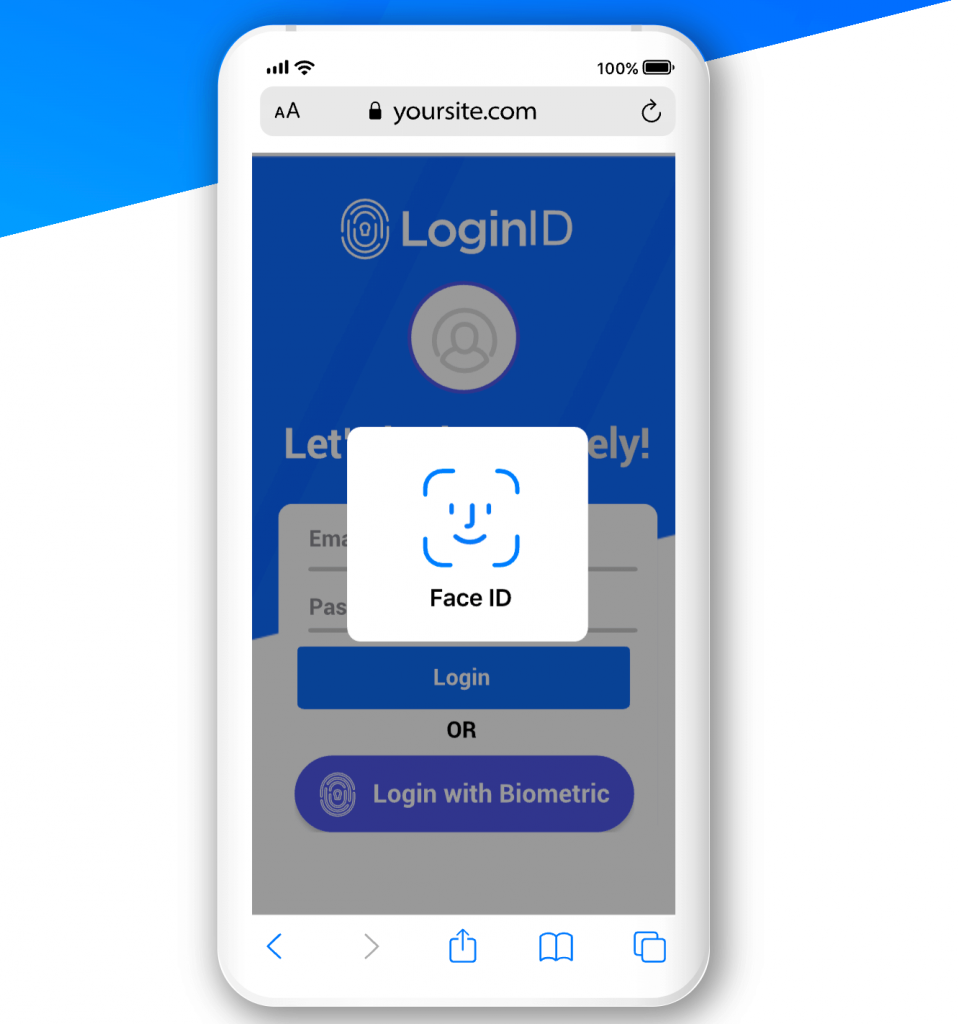

For businesses that use WordPress’ WooCommerce, they can install LoginID’s new plug-in that provides passwordless authentication for customers. This plug-in is FIDO certified and is meant to streamline online payment procedures, and eventually lower abandonment rates.

LoginID can benefit your business in three ways:

- Fully Passwordless Authentication

- 3D Secure and FIDO

- Payment Transaction Confirmation

Through the technologies we’ve mentioned, customers can have a great and secure biometrics checkout experience — even online.

Future proofs your establishment

Diversifying your business’ payment methods by including biometrics payments helps your business remain relevant, especially during these challenging times. In addition, biometrics payments also allow your business to be ready for similar crises and be ahead of your competition. To seamlessly include biometrics payments in your business strategy, you should consult with an expert in financial services. These professionals are knowledgeable in relevant financial theory, and have developed a blend of key marketing and management skills, which then allows them to quickly react to rising business trends and challenges. With the help of financial services experts, you can seamlessly employ biometrics payments and prepare your business for the future, while still providing your customers with quality service.

Better payment security

Customers have also been choosing biometrics payments over traditional methods as these offer a higher level of security for customers. Because biometrics payments rely on the uniqueness of the user’s physical features, it is less prone to falling victim to fraud and other security issues.

To illustrate, if businesses were to use retina scanners to verify a customer, it would be almost impossible for fraudsters and cybercriminals to gain access to the user’s payment information, since the biometric is distinctive to the individual. And unlike transactions that are processed using physical cards, customers won’t have to worry about having their card stolen or compromised if they opt for biometrics payment methods.

All in all, you should strongly consider adding biometrics as an alternative payment option for your business. Aside from preparing your business for future challenges, it also allows for better security and improves customer satisfaction. For more business and online commerce insights, do visit our blog.

Guest Author Jadie Bednar works as an executive business consultant and she's often astounded by their innovation. She takes it upon herself to help businesses realize their potential and boost the productivity. And when she isn't brainstorming with other entrepreneurs, she's working on her book.