Chasing down late payments is a frustrating task for every business owner, and if you’ve found yourself in this position recently, you’d probably like to avoid this scenario again in the future. But even if a customer occasionally pays late, you might be wondering how you can maintain some of these valuable relationships. Ecommerce tools provided by YayCommerce can help you drive sales through your website, and these tips will show you how to secure late payments while prioritizing customer satisfaction.

Use the Right Software

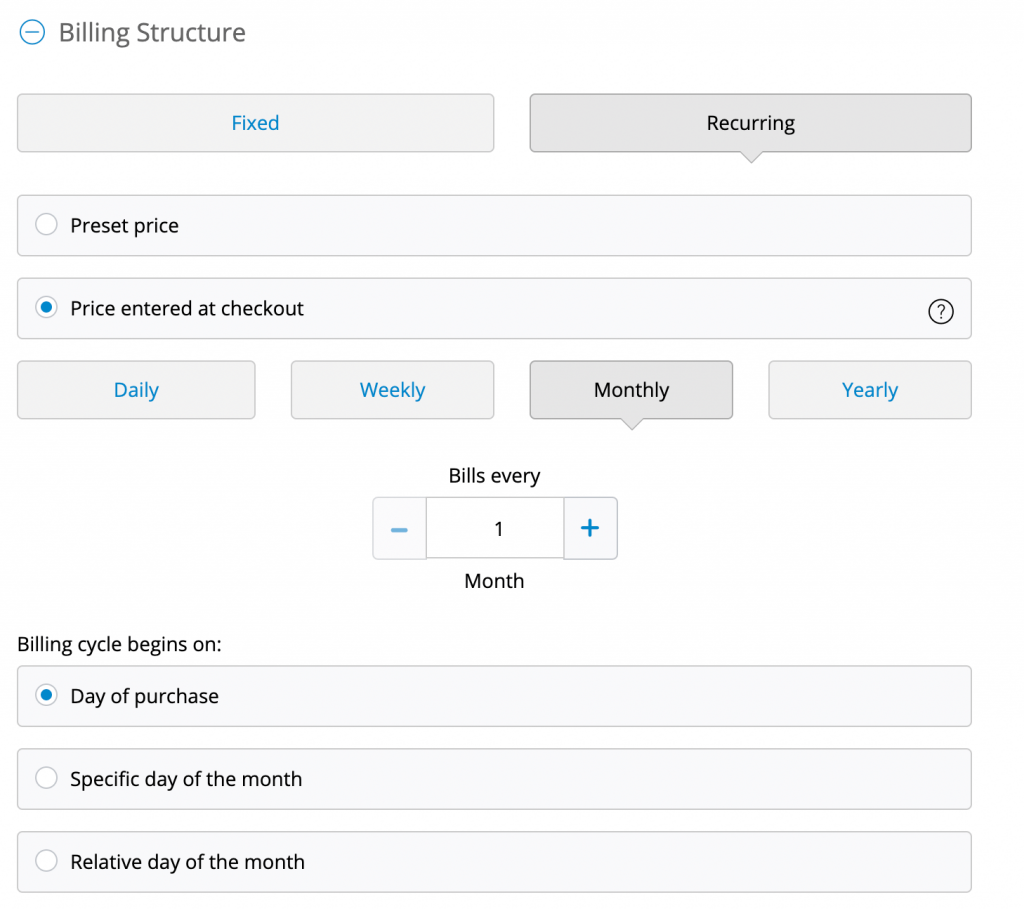

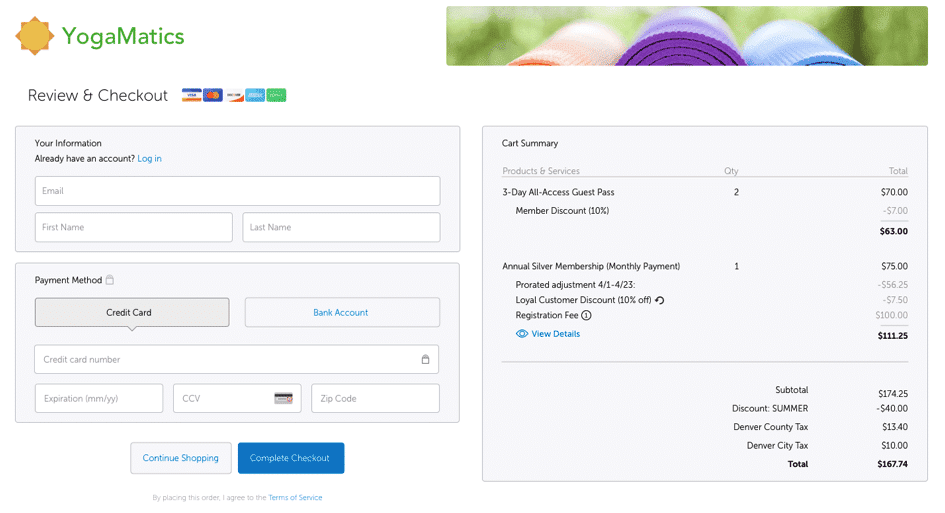

If you’re creating, sending, and processing all of your invoices manually, investing in invoicing and payment processing software can help you save time and easily collect payments in the future, according to Zenbusiness. This will also allow you to accept diverse payment options from your customers.

With payment processing software, you’ll likely find that you get paid more quickly, and you’ll also be able to process payments in various currencies.

Create a Payment Schedule

If you are currently trying to secure late payments from particular customers, it’s time to have open conversations with them. Be patient and understanding, and give them a chance to explain the reasons behind the delay.

Once you’ve learned a little more about their situation, you and your customer can work together to negotiate a payment plan.

They might be able to pay you in installments over the next few weeks, and you can factor this into your budget and cash flow projections.

Collect Deposits

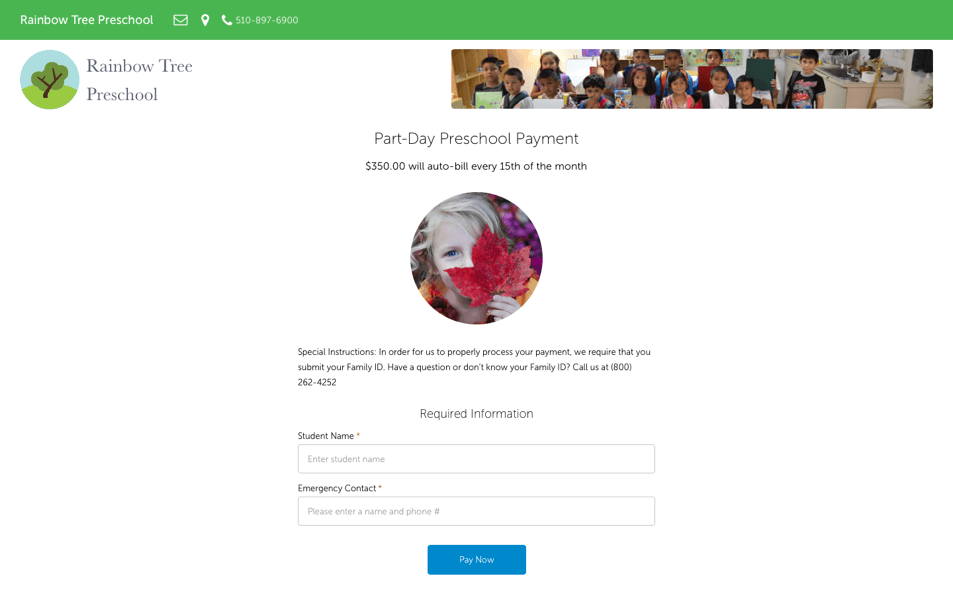

How can you ensure that you start receiving payments on time? You can begin by requiring a deposit for major transactions with new customers.

Invoice2Go recommends notifying potential customers about required deposits in your estimates or bids for projects. The size of the deposit should depend on the pricing for the overall project. For an expensive project, it’s a smart idea to require customers to pay 25% of the fee upfront and put down another 25% deposit halfway through the project.

Send Reminders

Sometimes, customers simply lose track of invoices and forget when a particular payment is due. This is why you should start sending automated responses before and on payment due dates.

Make sure to keep your reminders friendly, cordial, and brief – you don’t want to sound pushy, but you also want to encourage them to be prompt with their payments.

You may be able to find invoicing software that allows you to set up reminder emails, or you might have to use an email scheduling tool to write and schedule them in advance. Verify that you have the right email address for the employee in charge of accounts!

Late Fees and Early Discounts

Including late fees on invoices will help encourage customers to pay on time – after all, no one wants to pay more for the same service.

But by offering discounts to customers who pay ahead of time, you can also incentivize early payments, which can help to boost your cash flow. If you’re curious about the other benefits of offering discounts, PrimeRevenue states that early payment discounts can improve your relationships with your customers and strengthen customer loyalty. But it’s important to be discerning about who you give these discounts to – offering them to every customer could lower your revenue.

To Wrap Up

Trying to secure late payments is definitely stressful. But with these tips, you can secure the money you’re owed, keep your customers on board, and reduce the risks of dealing with this situation again later down the road. You don’t have to sacrifice the money you’re owed or your relationships with your customers!

Want to integrate your ecommerce tools to boost sales? YayCommerce extensions can supercharge your ecommerce sales. Browse our products and solutions on our website today.

[…] You can set up automatic payment reminders if clients don’t pay their invoices on time, which will save you the headache of having to follow up on late payments. […]